Table of Contents

- What are Citi ThankYou Points?

- Current Citi ThankYou Points Transfer Partners

- How to Earn Citi ThankYou Points

- Understanding Citi ThankYou Points Transfer Ratios and Times

- How to Transfer Citi ThankYou Points to Airline Partners

- Best Ways to Use Citi ThankYou Points

- Citi ThankYou Points Transfer Bonuses

- Is it Worth Transferring Citi ThankYou Points?

- Citi ThankYou Points Transfer FAQ

- Conclusion

What are Citi ThankYou Points?

Citi ThankYou Points are a flexible rewards currency offered by Citibank on various credit cards. Unlike airline-specific miles or hotel points, ThankYou Points offer versatility, allowing you to redeem them for a wide range of options including gift cards, merchandise, cash back, and most importantly for travelers, transfers to a variety of airline loyalty programs. This flexibility makes them a valuable asset for those looking to maximize their travel rewards.

Current Citi ThankYou Points Transfer Partners

Below you can find an always up-to-date list of all the airlines that you can transfer your Citi ThankYou Points to.

| Airline | Standard Transfer Ratio | Estimated Transfer Time |

|---|---|---|

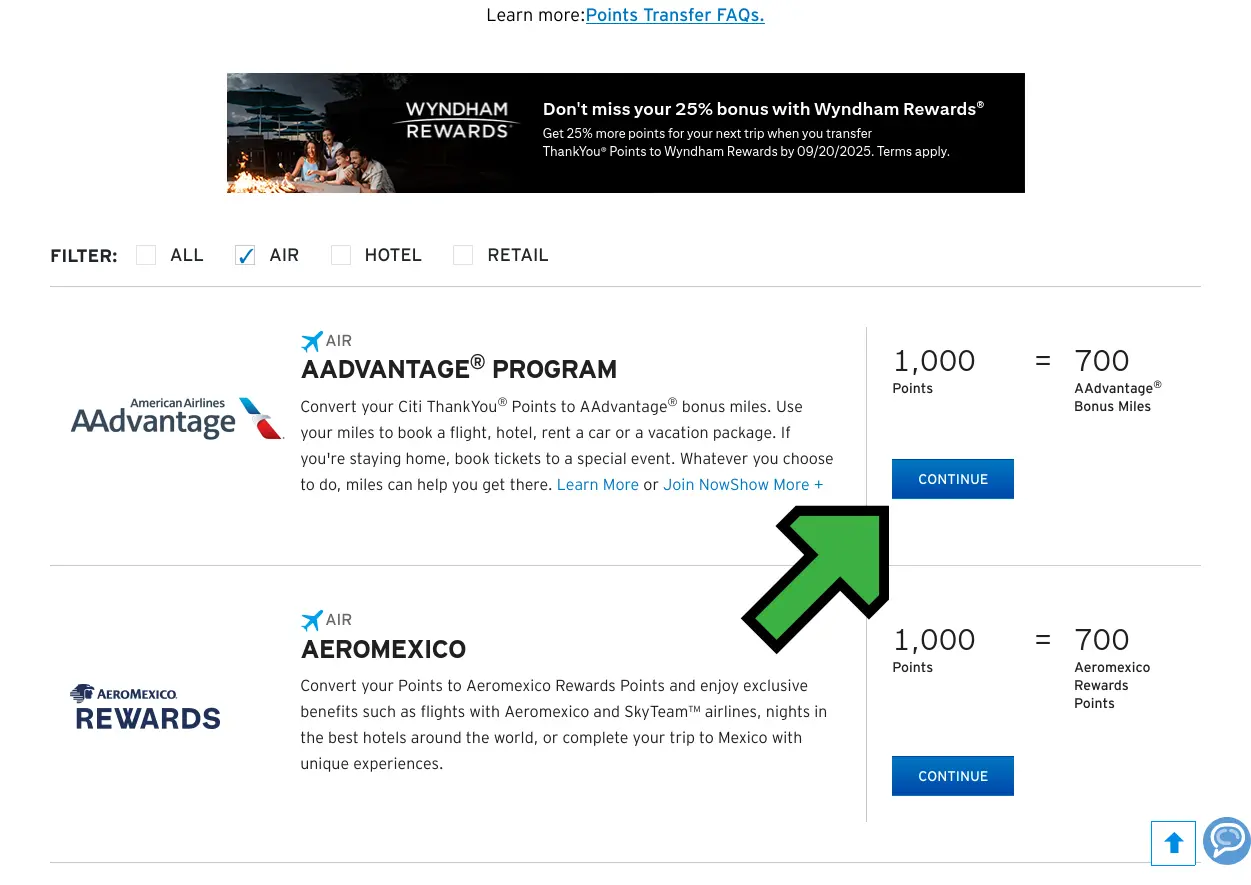

| Aeromexico (Club Premier) | 1:1 | ~24 Hours |

| Air France/KLM (Flying Blue) | 1:1 | Instant |

| Avianca (LifeMiles) | 1:1 | Instant |

| Cathay Pacific (Asia Miles) | 1:1 | ~24-48 Hours |

| Emirates (Skywards) | 1:1 | ~24 Hours |

| Etihad Airways (Etihad Guest) | 1:1 | ~24 Hours |

| EVA Air (Infinity MileageLands) | 1:1 | ~48 Hours |

| JetBlue (TrueBlue) | 1:1* | Instant |

| Qantas (Qantas Frequent Flyer) | 1:1 | ~24 Hours |

| Qatar Airways (Privilege Club) | 1:1 | ~24 Hours |

| Singapore Airlines (KrisFlyer) | 1:1 | ~24-48 Hours |

| Thai Airways (Royal Orchid Plus) | 1:1 | ~24-48 Hours |

| Turkish Airlines (Miles&Smiles) | 1:1 | ~24 Hours |

| Virgin Atlantic (Flying Club) | 1:1 | Instant |

*Note: The standard 1:1 transfer ratio to JetBlue TrueBlue typically applies to points earned with Citi Premier® and Citi Prestige® cards. Points from other Citi cards may transfer at a 1:0.8 ratio. Always verify the ratio in your ThankYou account before transferring.

How to Earn Citi ThankYou Points

Citi ThankYou Points are primarily earned through a variety of Citi credit cards. The earning rates vary by card and spending category, allowing you to maximize your points based on your spending habits. Some of the most popular cards for earning ThankYou Points include:

- Citi Strata Premier℠ Card: This card is a powerhouse for earning ThankYou Points, offering accelerated earning on travel, dining, supermarkets, and gas stations. It's often considered the flagship card for ThankYou Rewards.

- Citi Custom Cash® Card: Earn 5% cash back (as ThankYou Points) on your highest eligible spending category each billing cycle, up to $500 spent, then 1% back. This card is excellent for optimizing spending in a specific category.

- Citi Double Cash® Card: Earn 2% cash back on all purchases—1% when you buy and 1% when you pay. While marketed as a cash back card, the rewards are issued as ThankYou Points, making it a great everyday earner.

- Citi Rewards+® Card: This card offers bonus points on small purchases and rounds up to the nearest 10 points on every purchase, making it ideal for those who make many small transactions.

You can also earn ThankYou Points through various promotions, banking relationships, and by linking your eligible Citi checking account.

Understanding Citi ThankYou Points Transfer Ratios and Times

When transferring Citi ThankYou Points to airline partners, it's crucial to understand both the transfer ratio and the estimated transfer time. Most of Citi's airline partners transfer at a 1:1 ratio, meaning 1,000 ThankYou Points become 1,000 airline miles. However, there are exceptions, such as JetBlue TrueBlue, which may transfer at a lower ratio depending on the specific Citi card you hold.

Transfer times can vary significantly, from instant transfers to those that take up to 48 hours or more. Instant transfers are ideal for booking last-minute award flights, while longer transfers require more planning. Always factor in these times when planning your award travel to ensure your points arrive before your desired redemption becomes unavailable.

How to Transfer Citi ThankYou Points to Airline Partners

Transferring your Citi ThankYou Points to an airline partner is a straightforward process, but it requires careful attention to detail. Here's a general step-by-step guide:

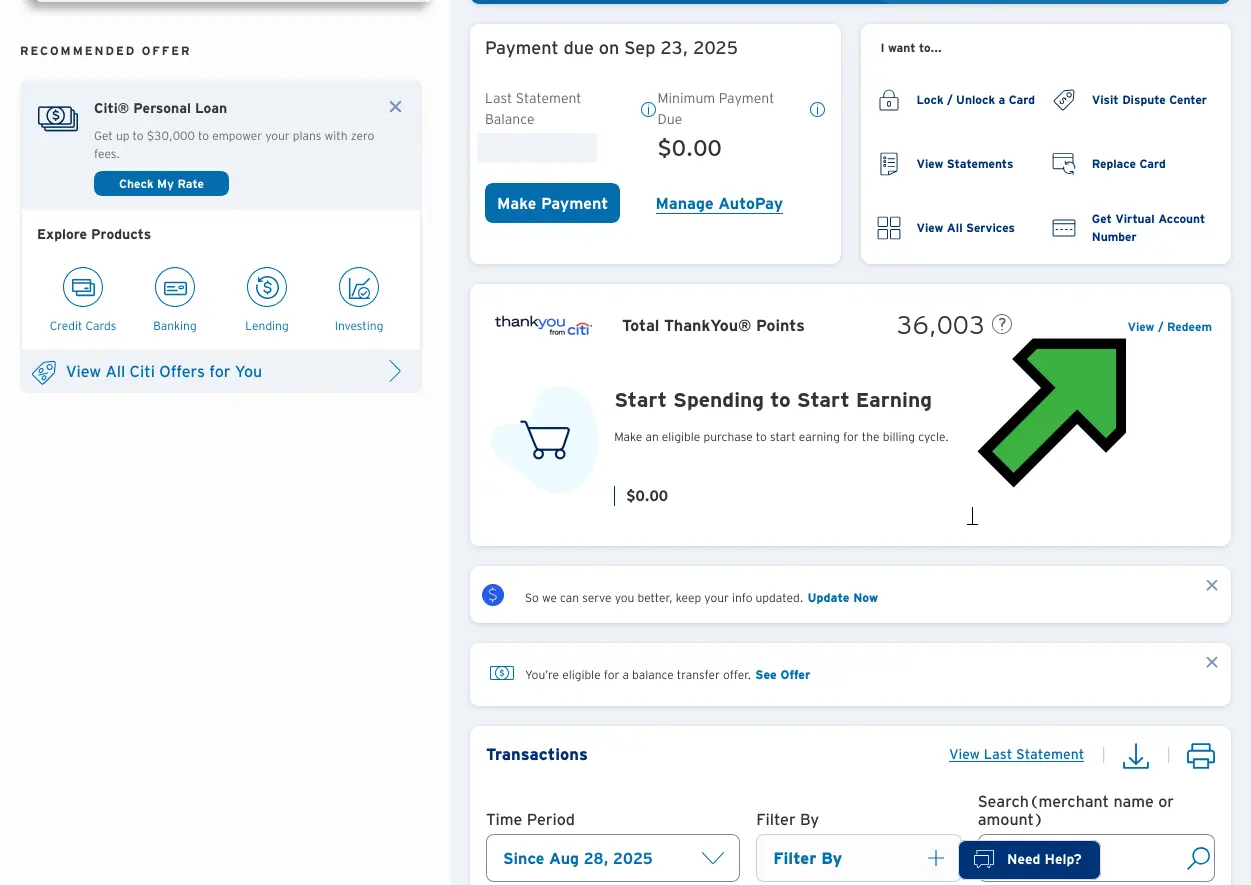

- Log in to your Citi ThankYou Rewards account: Access your account through the Citi website or mobile app.

- Click on the "View/Redeem" in the ThankYou Points section: Find it next to your current point balance.

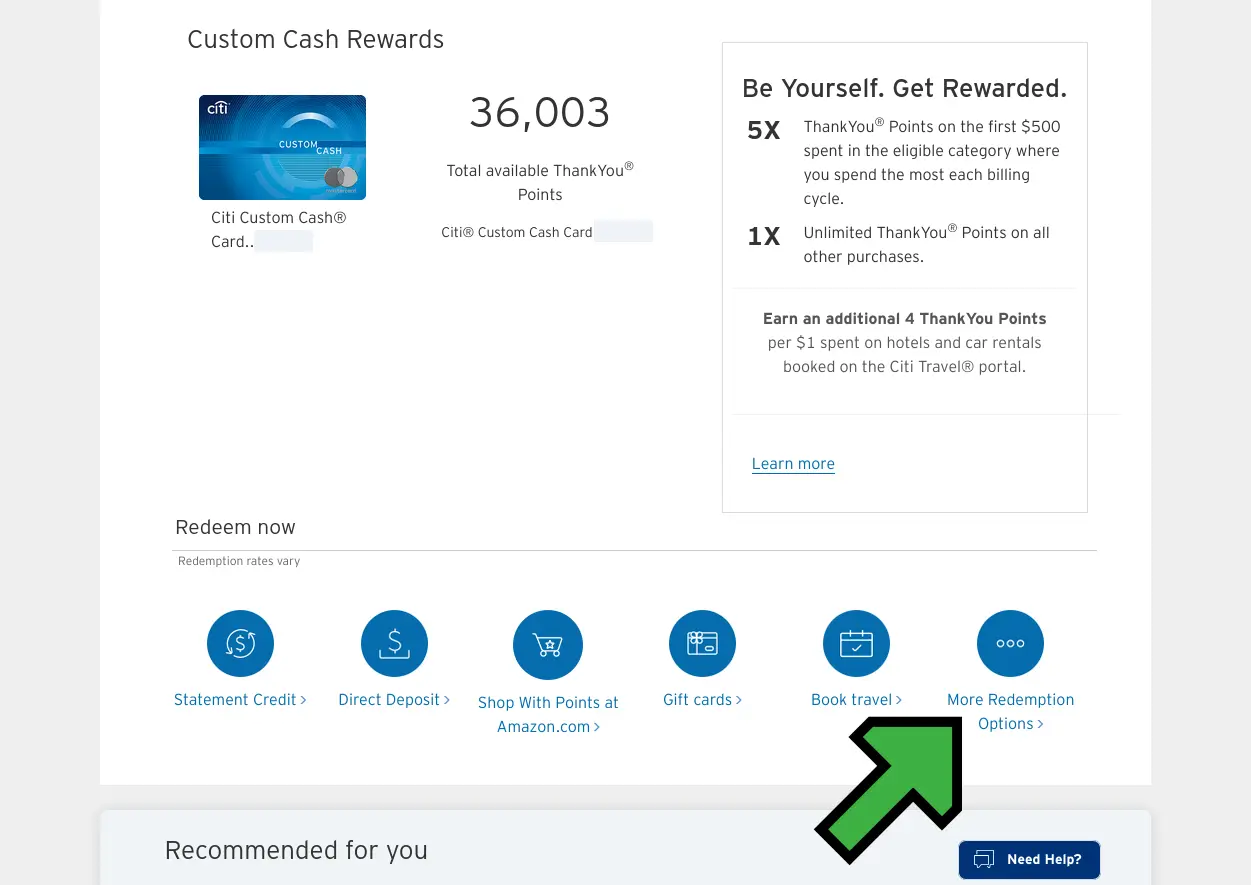

- Select "More Redemption Options": This will take you to the actual ThankYou points site.

- Scroll to the bottom and find the "Points Transfer" option: You might need to check the second page of options.

- Select your desired airline partner: Choose from the list of available transfer partners.

- Enter your airline loyalty program details: You'll need your frequent flyer number for the chosen airline. Ensure the name on your Citi ThankYou Rewards account matches the name on your airline loyalty account to avoid issues.

- Specify the number of points to transfer: Transfers are typically done in increments of 1,000 points.

- Confirm the transfer: Review all details, including the transfer ratio and estimated transfer time, before finalizing the transaction.

Important Considerations:

- Matching Names: The name on your Citi ThankYou Rewards account must match the name on your airline loyalty program account.

- Irreversible Transfers: Once points are transferred to an airline partner, the transfer is generally irreversible. Make sure you have a specific redemption in mind before initiating a transfer.

- Transfer Bonuses: Keep an eye out for limited-time transfer bonuses, which can offer an increased transfer ratio (e.g., 1:1.25), providing even greater value for your points.

Best Ways to Use Citi ThankYou Points

The "best" way to use your Citi ThankYou Points largely depends on your travel goals and flexibility. However, some airline partners consistently offer outsized value for redemptions. Here are a few examples of how you can maximize your ThankYou Points:

- Singapore Airlines KrisFlyer: Known for its excellent premium cabin redemptions on Singapore Airlines, including their Suites Class.

- Virgin Atlantic Flying Club: Offers great value for flights on Delta (especially business class to Europe) and ANA (First and Business Class to Japan).

- Turkish Airlines Miles&Smiles: Can be a sweet spot for domestic flights on United Airlines within the US, often requiring fewer miles than booking directly with United.

- Avianca LifeMiles: Often has competitive redemption rates for Star Alliance flights and frequently offers sales on purchased miles, which can be combined with transfers.

Always compare redemption rates across different partners and consider the cash price of the flight to determine if transferring points offers good value.

Citi ThankYou Points Transfer Bonuses

Citi occasionally offers limited-time transfer bonuses to select airline partners. These bonuses can significantly increase the value of your ThankYou Points, making certain redemptions even more attractive. For example, a 25% transfer bonus to Virgin Atlantic Flying Club would mean that 1,000 ThankYou Points become 1,250 Flying Club miles.

It's always a good idea to check for current transfer bonuses before making any transfers. These promotions are typically announced on the Citi ThankYou Rewards website and various travel blogs. Timing your transfers with these bonuses can lead to substantial savings on award flights.

Is it Worth Transferring Citi ThankYou Points?

Transferring Citi ThankYou Points to airline partners is often the most lucrative way to redeem them, especially for international business or first-class travel. While other redemption options like gift cards or cash back offer a fixed value (typically 0.5 to 1 cent per point), strategic airline transfers can yield a value of 2 cents per point or even higher.

The decision to transfer points should be based on:

- Your Travel Goals: Do you have a specific award flight in mind?

- Availability: Are award seats available on your desired dates and routes?

- Cash Price vs. Point Value: Does the value you're getting from your points outweigh the cash cost of the flight?

- Transfer Bonuses: Are there any active transfer bonuses that enhance the value of your points?

For those willing to put in a bit of research and planning, transferring Citi ThankYou Points can unlock incredible travel experiences that would otherwise be very expensive.

Citi ThankYou Points Transfer FAQ

Do Citi ThankYou Points expire?

Citi ThankYou Points generally do not expire as long as your ThankYou Rewards account remains open and in good standing. However, if you close a card that earns ThankYou Points, you typically have a grace period (e.g., 60-90 days) to use or transfer your points before they are forfeited. Always check the specific terms and conditions of your Citi account.

Can I transfer Citi ThankYou Points to someone else's airline account?

Generally, Citi ThankYou Points must be transferred to an airline loyalty account in your name. Some programs may allow transfers to authorized users on your credit card account, but direct transfers to unrelated third parties are usually not permitted.

Are there fees for transferring Citi ThankYou Points?

Citi does not typically charge a fee for transferring ThankYou Points to airline partners. However, some airline programs may impose their own fees or taxes on award bookings, which are separate from the point transfer itself.

Which Citi card is best for earning ThankYou Points?

The "best" card depends on your spending habits. The Citi Strata Premier℠ Card is excellent for broad travel and dining categories, while the Citi Custom Cash® Card excels in a single high-spending category. The Citi Double Cash® Card is great for everyday spending with its flat 2% earning rate.

How much are Citi ThankYou Points worth?

The value of Citi ThankYou Points varies significantly depending on how you redeem them. For cash back or gift cards, they typically yield 0.5 to 1 cent per point. However, when transferred strategically to airline partners for premium cabin award flights, they can be worth 2 cents per point or more, offering the highest potential value.

Conclusion

Citi ThankYou Points offer a powerful and flexible way to achieve your travel goals, especially when utilized through their extensive network of airline transfer partners. By understanding how to earn, transfer, and redeem these points strategically, you can unlock incredible value for flights around the globe. Always keep an eye on transfer bonuses and compare redemption options to ensure you're maximizing the value of your hard-earned points. Happy travels!

Disclaimer: Always use credit responsibly. This guide is for informational purposes only and does not constitute financial advice.