Table of Contents

- What are Chase Ultimate Rewards Points?

- Current Ultimate Reward Transfer Partners

- How to Earn Chase Ultimate Rewards Points

- Understanding Chase Ultimate Rewards Transfer Ratios and Times

- How to Transfer Chase Ultimate Rewards Points to Airline Partners

- Best Ways to Use Chase Ultimate Rewards Points

- Chase Ultimate Rewards Transfer Bonuses

- Is it Worth Transferring Chase Ultimate Rewards Points?

- Chase Ultimate Rewards Transfer FAQ

- Conclusion

What are Chase Ultimate Rewards Points?

Chase Ultimate Rewards are one of the most valuable and flexible points currencies in the travel rewards world. Offered on a suite of popular Chase credit cards, these points can be redeemed for a variety of options, including cash back, gift cards, travel booked through the Chase travel portal, and most importantly for maximizing value, direct transfers to a diverse group of airline and hotel loyalty programs. Their flexibility and the strength of their transfer partners make them a cornerstone for many savvy travelers.

Current Ultimate Reward Transfer Partners

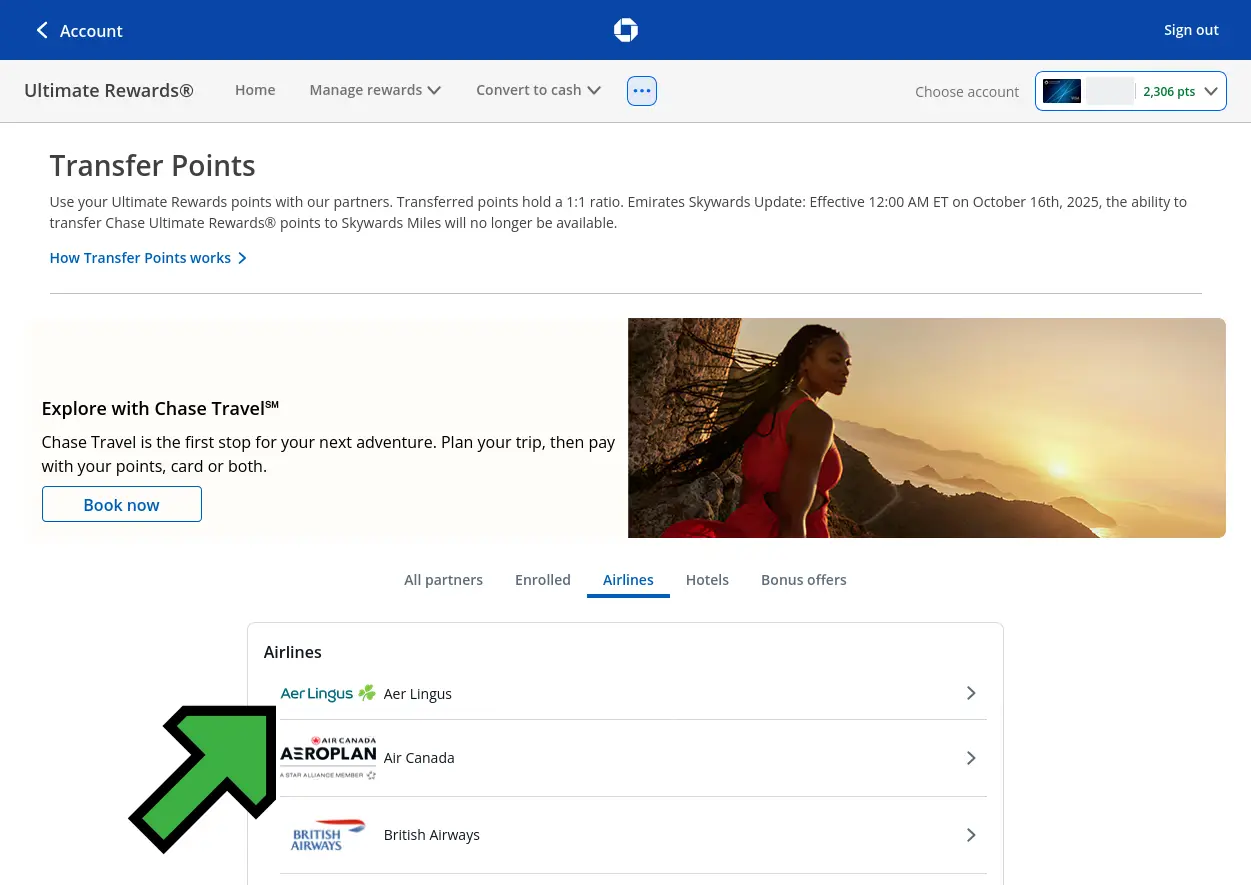

Below you can find an always up-to-date list of all the airlines that you can transfer your Chase Ultimate Rewards points to.

| Airline | Standard Transfer Ratio | Estimated Transfer Time |

|---|---|---|

| Aer Lingus (AerClub) | 1:1 | Instant |

| Air Canada (Aeroplan) | 1:1 | Instant |

| Air France/KLM (Flying Blue) | 1:1 | Instant |

| British Airways (Executive Club) | 1:1 | Instant |

| Emirates (Skywards) | 1:1 | Instant |

| Iberia (Iberia Plus) | 1:1 | Instant |

| JetBlue (TrueBlue) | 1:1 | Instant |

| Singapore Airlines (KrisFlyer) | 1:1 | ~1-2 Business Days |

| Southwest Airlines (Rapid Rewards) | 1:1 | Instant |

| United Airlines (MileagePlus) | 1:1 | Instant |

| Virgin Atlantic (Flying Club) | 1:1 | Instant |

How to Earn Chase Ultimate Rewards Points

Chase Ultimate Rewards points are primarily earned through a suite of popular Chase credit cards. The earning rates vary by card and spending category, allowing you to maximize your points based on your spending habits. Some of the most popular cards for earning Ultimate Rewards points include:

- Chase Sapphire Preferred® Card: A favorite among travelers, this card offers bonus points on travel and dining, making it an excellent choice for everyday spending.

- Chase Sapphire Reserve®: The premium travel card from Chase, offering higher earning rates on travel and dining, along with a host of luxury travel benefits.

- Chase Freedom Flex℠: Earn 5% cash back (as Ultimate Rewards points) on up to $1,500 in combined purchases in bonus categories each quarter you activate, and 1% on all other purchases.

- Chase Freedom Unlimited®: Earn 1.5% cash back (as Ultimate Rewards points) on all purchases, making it a solid choice for non-bonus spending.

- Ink Business Preferred® Credit Card: A top business card offering bonus points on travel, shipping, internet, cable, phone services, and advertising purchases.

Combining these cards, often referred to as the "Chase Trifecta," allows you to maximize earning across various spending categories and then pool your points into a premium card (like the Sapphire Preferred or Reserve) for transfers to travel partners.

Understanding Chase Ultimate Rewards Transfer Ratios and Times

Chase Ultimate Rewards points transfer to all their airline and hotel partners at a 1:1 ratio, meaning 1,000 Ultimate Rewards points become 1,000 airline miles or hotel points. This consistent ratio simplifies the transfer process and makes it easy to calculate the value of your redemptions.

One of the significant advantages of Chase Ultimate Rewards is the speed of transfers. Most airline partners offer instant transfers, which is incredibly valuable for booking award flights, especially when availability is limited. Hotel transfers are also generally instant. Always double-check the estimated transfer time before initiating a transfer, but for most Chase partners, you can expect your points to appear in your loyalty account almost immediately.

How to Transfer Chase Ultimate Rewards Points to Airline Partners

Transferring your Chase Ultimate Rewards points to an airline partner is a straightforward process designed to be user-friendly. Here's a general step-by-step guide:

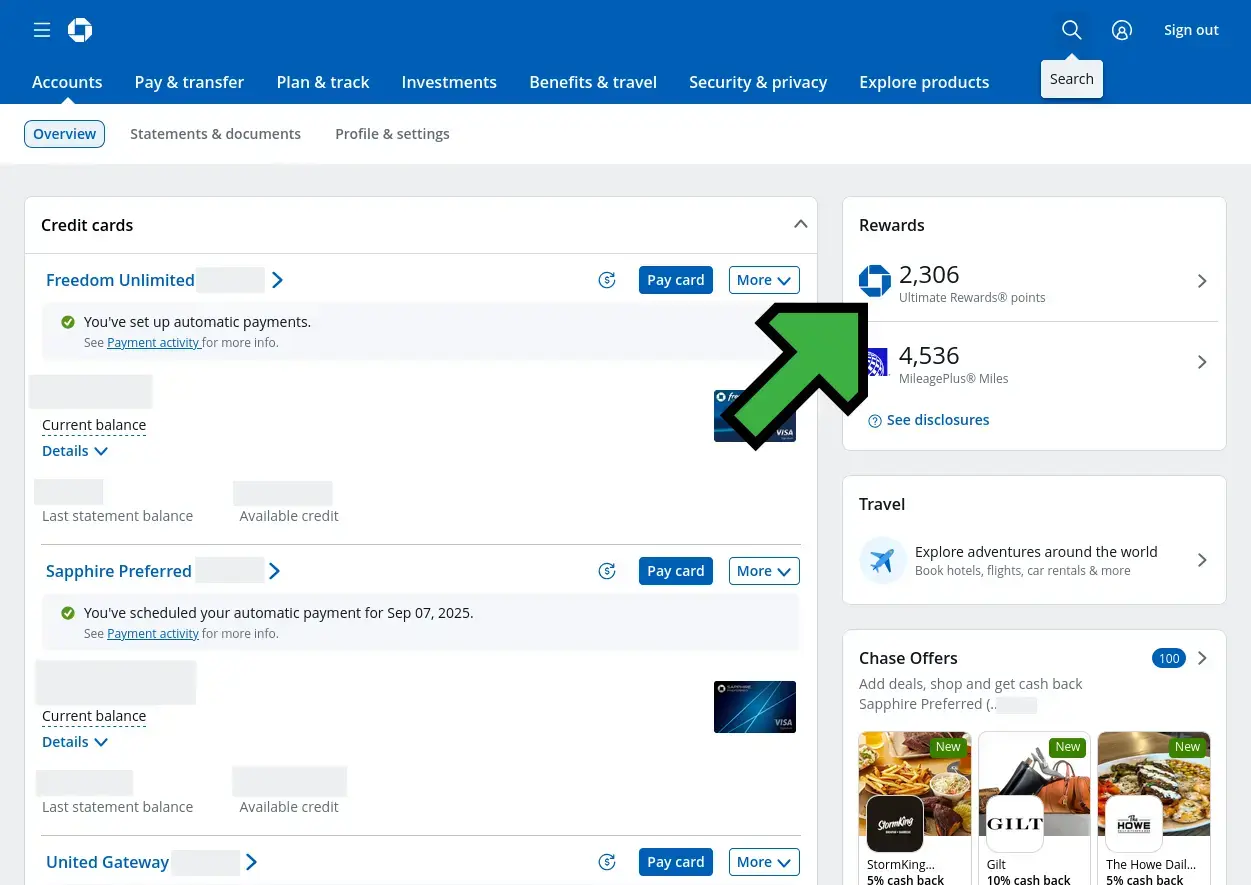

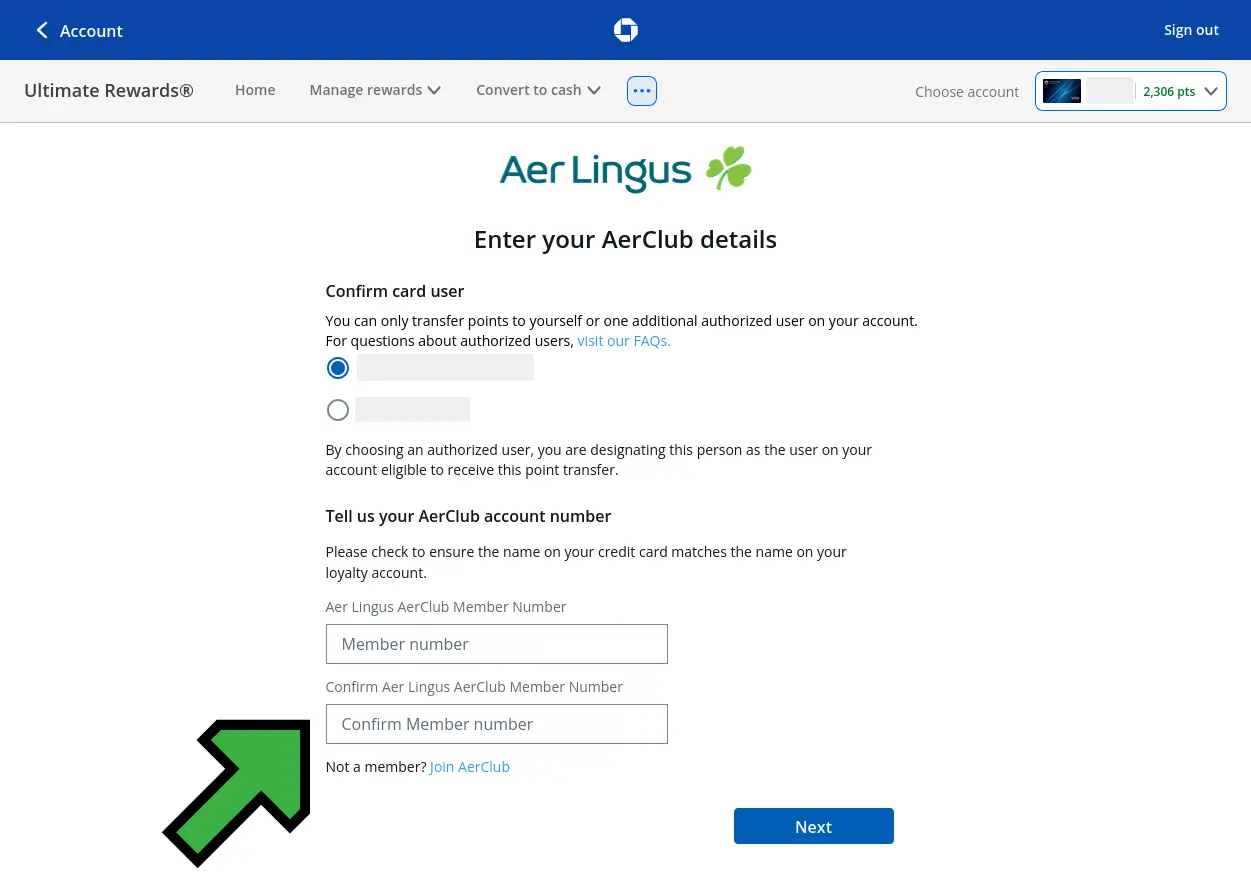

- Log in to your Chase Ultimate Rewards account: Access your account through the Chase website.

- Navigate to the "Ultimate Rewards" section: This is typically found on the right side of the main accounts page.

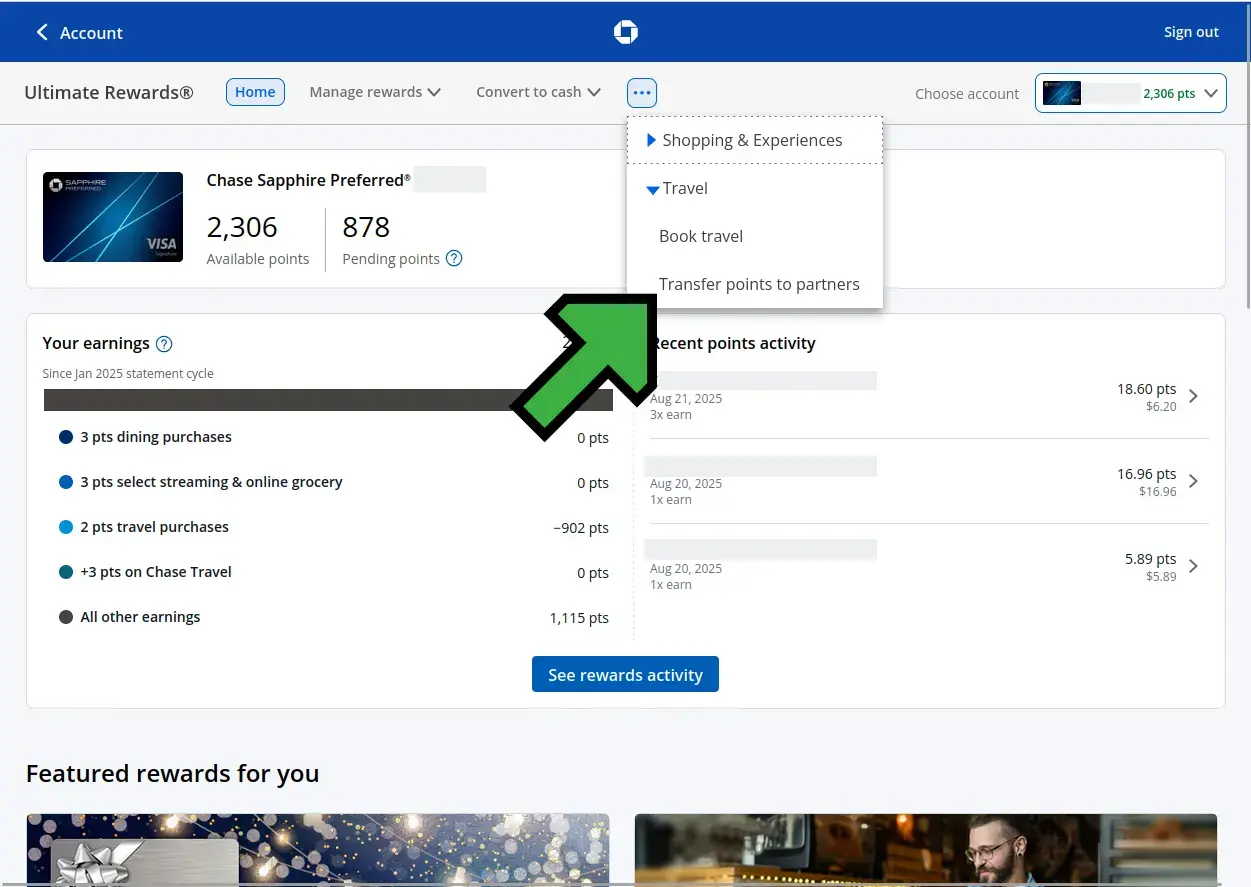

- Select "Transfer points to partners": You might need to click the three dots menu to see this option.

- Select your desired airline partner: Choose from the list of available transfer partners.

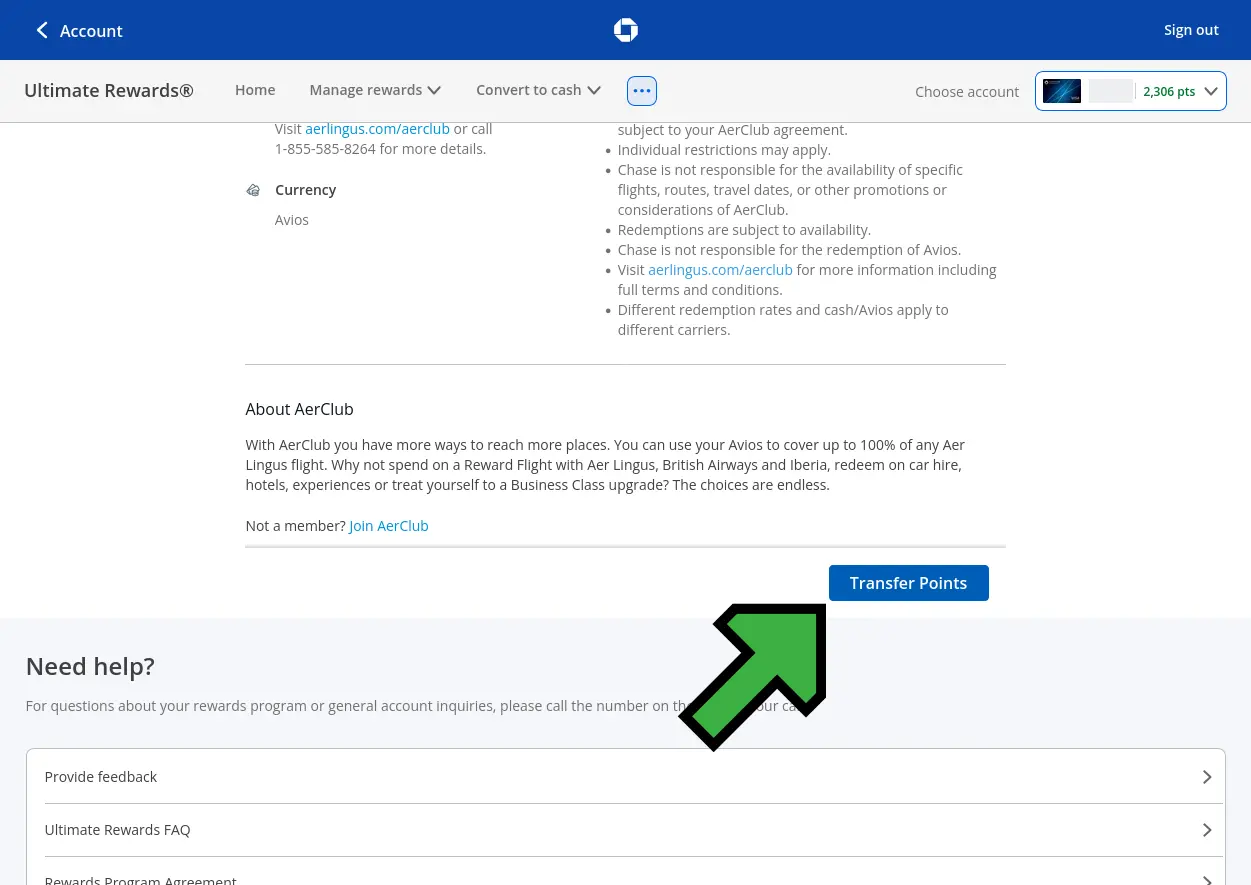

- Scroll down and click the "Transfer Points" button: It's all the way at the bottom of the page.

- Enter your airline loyalty program details: You'll need your frequent flyer number for the chosen airline. Ensure the name on your Chase Ultimate Rewards account matches the name on your airline loyalty account to avoid issues.

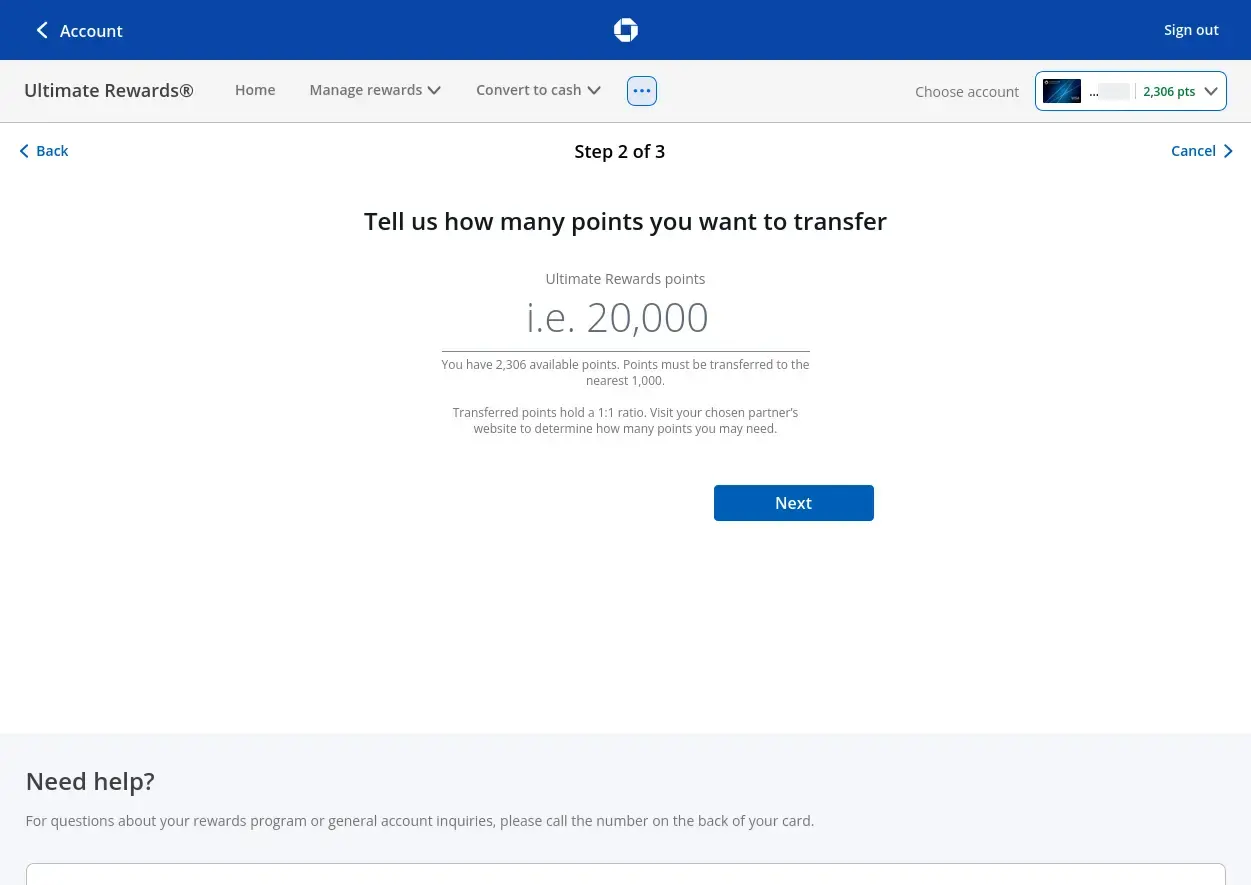

- Specify the number of points to transfer: Transfers required to be in increments of 1,000 points.

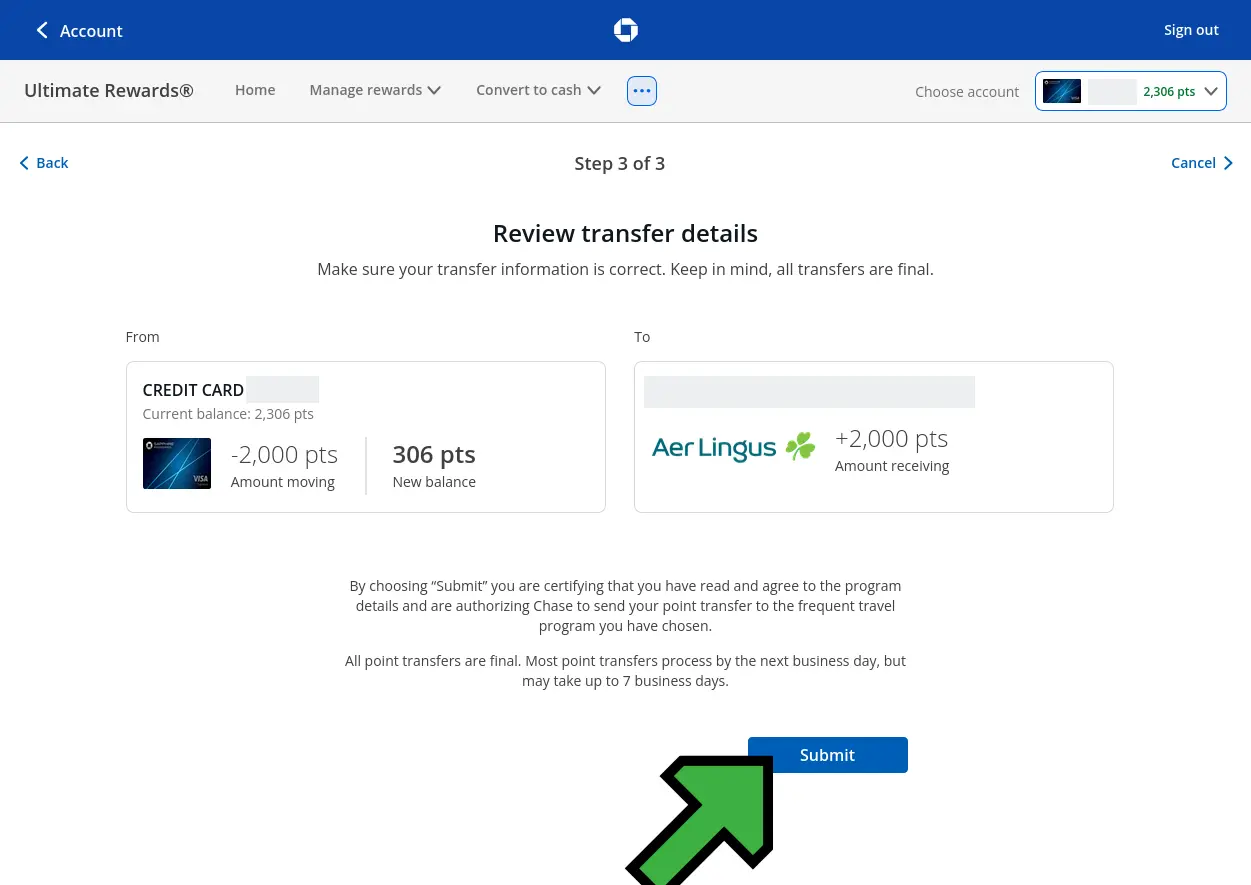

- Confirm the transfer: Review all details, including the transfer ratio and estimated transfer time, before finalizing the transaction.

Important Considerations:

- Matching Names: The name on your Chase Ultimate Rewards account must match the name on your airline loyalty program account.

- Irreversible Transfers: Once points are transferred to an airline partner, the transfer is generally irreversible. Make sure you have a specific redemption in mind before initiating a transfer.

- Transfer Bonuses: While less common than with other programs, Chase occasionally offers limited-time transfer bonuses to select partners, which can provide even greater value.

Best Ways to Use Chase Ultimate Rewards Points

Chase Ultimate Rewards points offer exceptional value, particularly when transferred to their airline and hotel partners. The "best" way to use them often involves leveraging sweet spots within partner loyalty programs for premium cabin travel. Here are a few examples:

- United Airlines MileagePlus: Excellent for domestic and international Star Alliance flights. You can often find good value for flights to Europe or Asia.

- Southwest Airlines Rapid Rewards: A great option for domestic flights within the US, especially for families, as points are tied to the cash price of the ticket and there are no blackout dates.

- Virgin Atlantic Flying Club: Offers fantastic value for booking Delta One business class flights to Europe or ANA First/Business Class to Japan.

- Hyatt (World of Hyatt): Widely considered the most valuable hotel transfer partner, offering luxurious stays at aspirational properties for a relatively low number of points.

- Singapore Airlines KrisFlyer: Ideal for booking premium cabins on Singapore Airlines, including their highly sought-after Suites Class.

Always compare redemption rates across different partners and consider the cash price of the flight or hotel to determine if transferring points offers good value.

Chase Ultimate Rewards Transfer Bonuses

While not as frequent as some other programs, Chase occasionally offers limited-time transfer bonuses to select airline or hotel partners. These bonuses can significantly increase the value of your Ultimate Rewards points, making certain redemptions even more attractive. For example, a 30% transfer bonus to a specific airline would mean that 1,000 Ultimate Rewards points become 1,300 airline miles.

It's always a good idea to check for current transfer bonuses before making any transfers. These promotions are typically announced on the Chase Ultimate Rewards portal and various travel blogs. Timing your transfers with these bonuses can lead to substantial savings on award travel.

Is it Worth Transferring Chase Ultimate Rewards Points?

Transferring Chase Ultimate Rewards points to airline and hotel partners is almost always the most valuable way to redeem them, especially for premium travel experiences. While other redemption options like cash back or booking through the Chase travel portal offer a fixed value (typically 1 to 1.5 cents per point), strategic transfers can yield a value of 2 cents per point or even higher.

The decision to transfer points should be based on:

- Your Travel Goals: Do you have a specific award flight or hotel stay in mind?

- Availability: Are award seats or rooms available on your desired dates and routes?

- Cash Price vs. Point Value: Does the value you're getting from your points outweigh the cash cost of the flight or hotel?

- Transfer Bonuses: Are there any active transfer bonuses that enhance the value of your points?

For those willing to put in a bit of research and planning, transferring Chase Ultimate Rewards points can unlock incredible travel experiences that would otherwise be very expensive.

Chase Ultimate Rewards Transfer FAQ

Do Chase Ultimate Rewards points expire?

Chase Ultimate Rewards points generally do not expire as long as your account remains open and in good standing. However, if you close a card that earns Ultimate Rewards points, you typically have a grace period (e.g., 30-90 days) to use or transfer your points before they are forfeited. Always check the specific terms and conditions of your Chase account.

Can I transfer Chase Ultimate Rewards points to someone else's airline or hotel account?

You can generally only transfer Chase Ultimate Rewards points to your own loyalty accounts or to the loyalty account of an authorized user on your Chase credit card account who lives at the same address. Direct transfers to unrelated third parties are not permitted.

Are there fees for transferring Chase Ultimate Rewards points?

Chase does not charge a fee for transferring Ultimate Rewards points to their travel partners. However, some airline programs may impose their own fees or taxes on award bookings, which are separate from the point transfer itself.

Which Chase card is best for earning Ultimate Rewards points?

The "best" card depends on your spending habits. The Chase Sapphire Preferred® Card and Chase Sapphire Reserve® are excellent for travel and dining. The Chase Freedom Flex℠ and Chase Freedom Unlimited® are great for maximizing earning in bonus categories and everyday spending, respectively. Many travelers use a combination of these cards to maximize their earning potential.

How much are Chase Ultimate Rewards points worth?

The value of Chase Ultimate Rewards points varies significantly depending on how you redeem them. For cash back, they are worth 1 cent per point. When redeemed for travel through the Chase travel portal, they are worth 1.25 cents per point with the Sapphire Preferred and 1.5 cents per point with the Sapphire Reserve. However, when transferred strategically to airline or hotel partners for premium cabin award flights or luxury hotel stays, they can be worth 2 cents per point or more, offering the highest potential value.

Conclusion

Chase Ultimate Rewards points are a cornerstone of any serious travel hacker's strategy, offering unparalleled flexibility and value when transferred to their diverse network of airline and hotel partners. By understanding the earning potential of various Chase cards, the simplicity of their 1:1 transfer ratios, and the strategic sweet spots within partner programs, you can unlock extraordinary travel experiences. Always stay informed about transfer bonuses and plan your redemptions carefully to maximize the value of your Ultimate Rewards points. Happy travels!

Disclaimer: Always use credit responsibly. This guide is for informational purposes only and does not constitute financial advice.