Table of Contents

- What are Capital One Miles?

- How to Earn Capital One Miles

- Understanding Capital One Miles Transfer Ratios and Times

- How to Transfer Capital One Miles to Airline Partners

- Best Ways to Use Capital One Miles

- Capital One Miles Transfer Bonuses

- Is it Worth Transferring Capital One Miles?

- Capital One Miles Transfer FAQ

- Conclusion

What are Capital One Miles?

Capital One Miles are a flexible travel rewards currency offered by Capital One on their popular travel credit cards. Unlike airline-specific miles, Capital One Miles provide versatility, allowing you to redeem them for a variety of travel-related expenses, including erasing travel purchases, booking through the Capital One travel portal, and most importantly for maximizing value, transferring to a diverse portfolio of airline loyalty programs. This flexibility makes them a strong contender for travelers seeking adaptable rewards.

Below you can find an always up-to-date list of all the airlines that you can transfer your Capital One Miles to.

| Airline | Standard Transfer Ratio | Estimated Transfer Time |

|---|---|---|

| Aer Lingus (AerClub) | 1:1 | Instant |

| Aeromexico (Club Premier) | 1:1 | ~24 Hours |

| Air Canada (Aeroplan) | 1:1 | Instant |

| Air France/KLM (Flying Blue) | 1:1 | Instant |

| Avianca (LifeMiles) | 1:1 | Instant |

| British Airways (Executive Club) | 1:1 | Instant |

| Cathay Pacific (Asia Miles) | 1:1 | ~24 Hours |

| Emirates (Skywards) | 1:1 | Instant |

| Etihad Airways (Etihad Guest) | 1:1 | ~24 Hours |

| EVA Air (Infinity MileageLands) | 1:0.75 | ~36 Hours |

| Finnair (Finnair Plus) | 1:1 | ~24 Hours |

| Qantas (Qantas Frequent Flyer) | 1:1 | Instant |

| Singapore Airlines (KrisFlyer) | 1:1 | ~24-48 Hours |

| TAP Air Portugal (Miles&Go) | 1:1 | Instant |

| Turkish Airlines (Miles&Smiles) | 1:1 | ~24 Hours |

| Virgin Atlantic (Flying Club) | 1:1 | Instant |

How to Earn Capital One Miles

Capital One Miles are primarily earned through their popular travel-focused credit cards. The earning rates are generally straightforward, making it easy to accumulate miles on everyday spending. Some of the most popular cards for earning Capital One Miles include:

- Capital One Venture X Rewards Credit Card: A premium travel card offering unlimited 2X miles on every purchase, every day, plus bonus miles on travel booked through Capital One Travel.

- Capital One Venture Rewards Credit Card: Earn unlimited 2X miles on every purchase, every day, making it a solid choice for consistent earning across all spending.

- Capital One VentureOne Rewards Credit Card: A no-annual-fee option that earns unlimited 1.25X miles on every purchase, every day.

- Capital One Spark Miles for Business: Designed for business owners, offering unlimited 2X miles on every purchase, every day.

Capital One's earning structure is generally simpler than some other programs, focusing on a high flat-rate earning across most categories, which appeals to those who prefer not to track bonus categories.

Understanding Capital One Miles Transfer Ratios and Times

Capital One Miles transfer to most of their airline partners at a 1:1 ratio, meaning 1,000 Capital One Miles become 1,000 airline miles. However, there are a few exceptions, such as EVA Air (Infinity MileageLands), which transfers at a 1:0.75 ratio. Always verify the specific ratio for your chosen partner before initiating a transfer.

Transfer times for Capital One Miles vary by partner. Many partners offer instant transfers, which is ideal for booking time-sensitive award flights. Other partners may take up to 24-48 hours or more. It's crucial to factor in these estimated transfer times when planning your award travel to ensure your miles arrive in your loyalty account before your desired redemption becomes unavailable.

How to Transfer Capital One Miles to Airline Partners

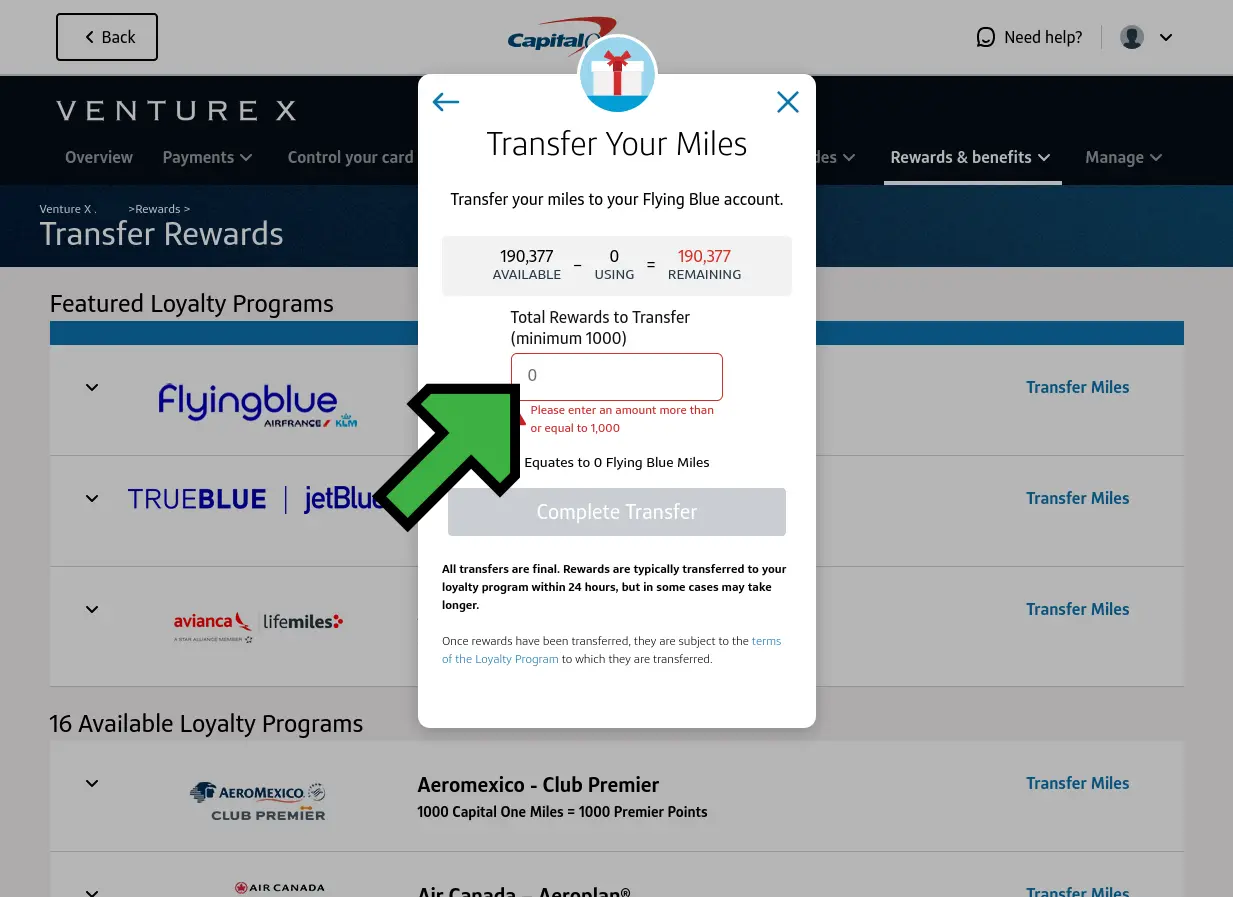

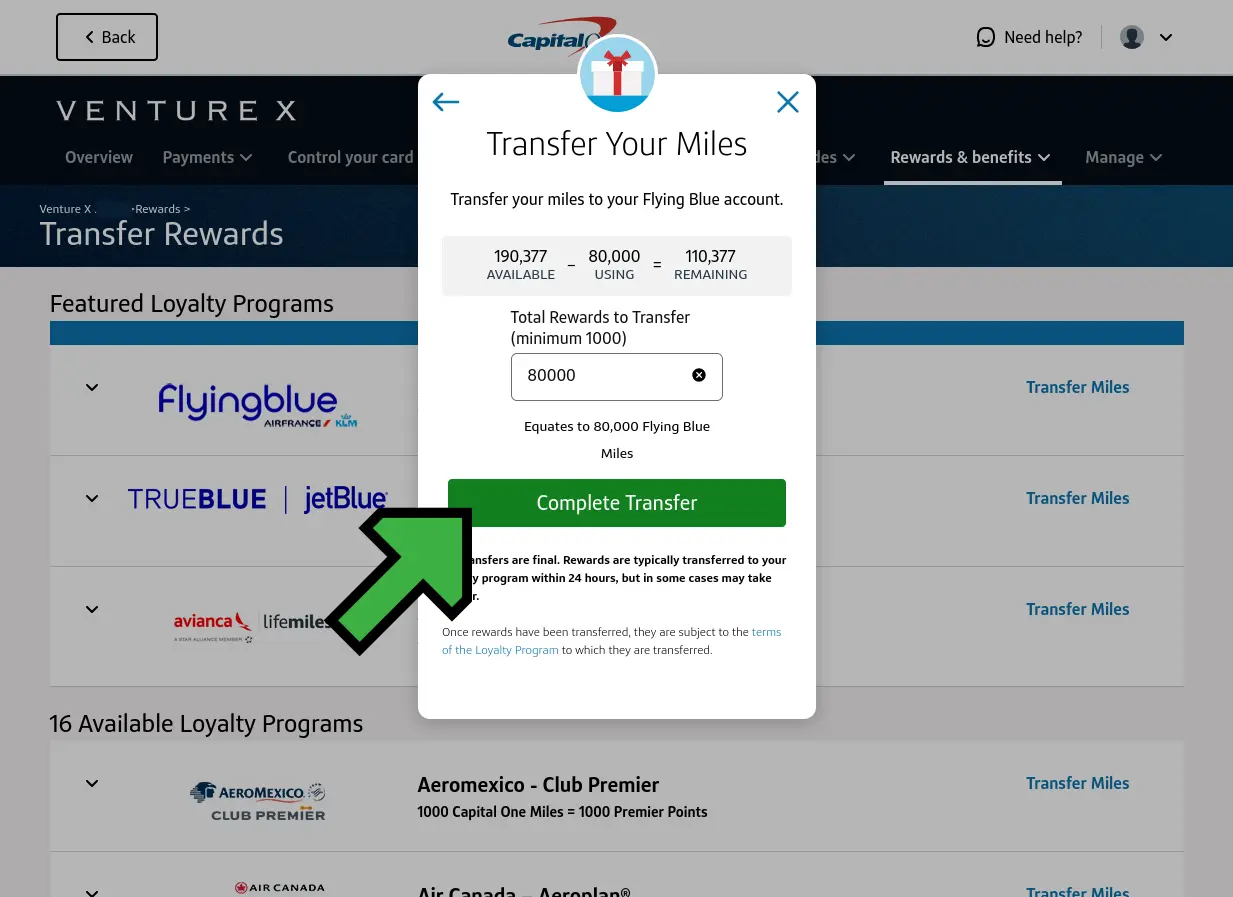

Transferring your Capital One Miles to an airline partner is a straightforward process. Here's a general step-by-step guide:

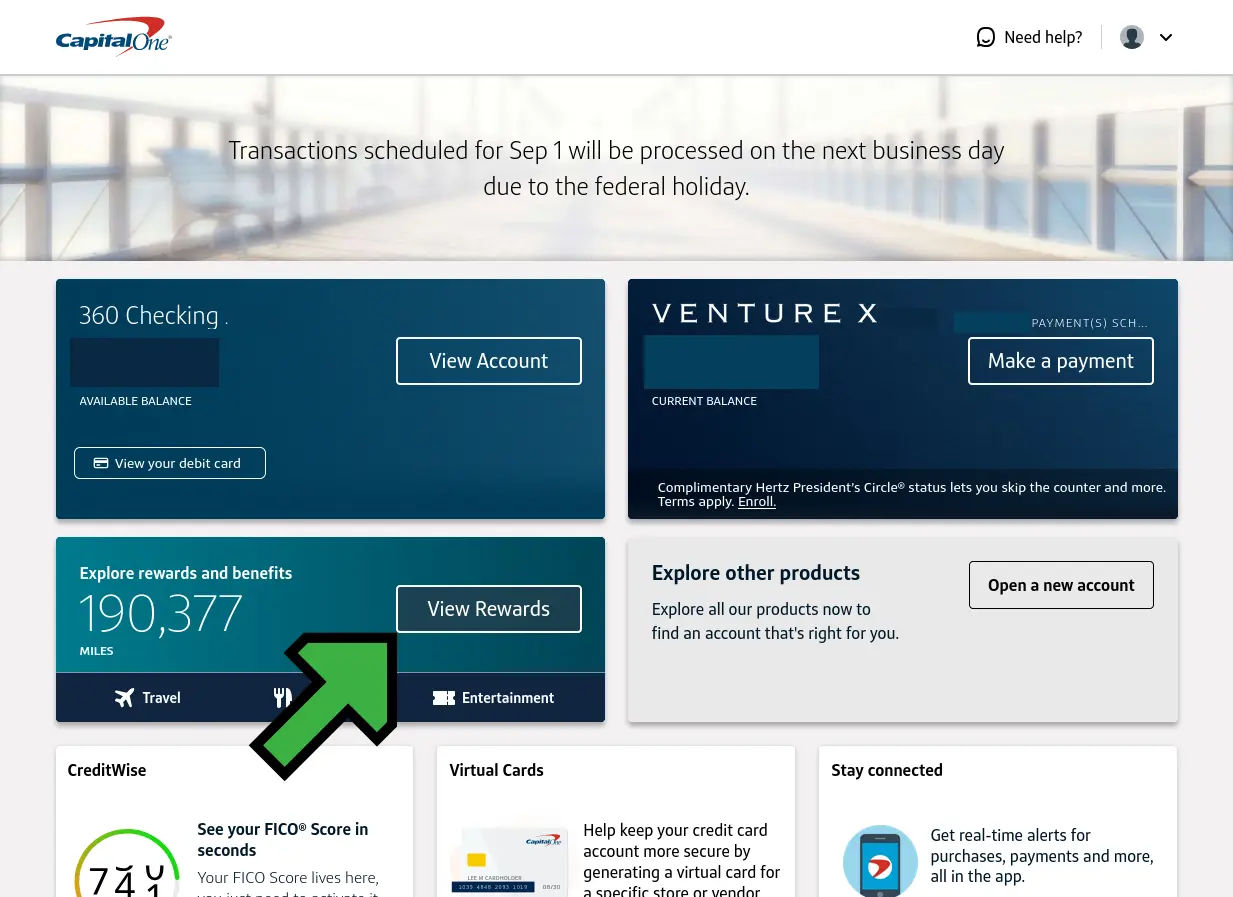

- Log in to your Capital One account: Access your account through the Capital One website or mobile app.

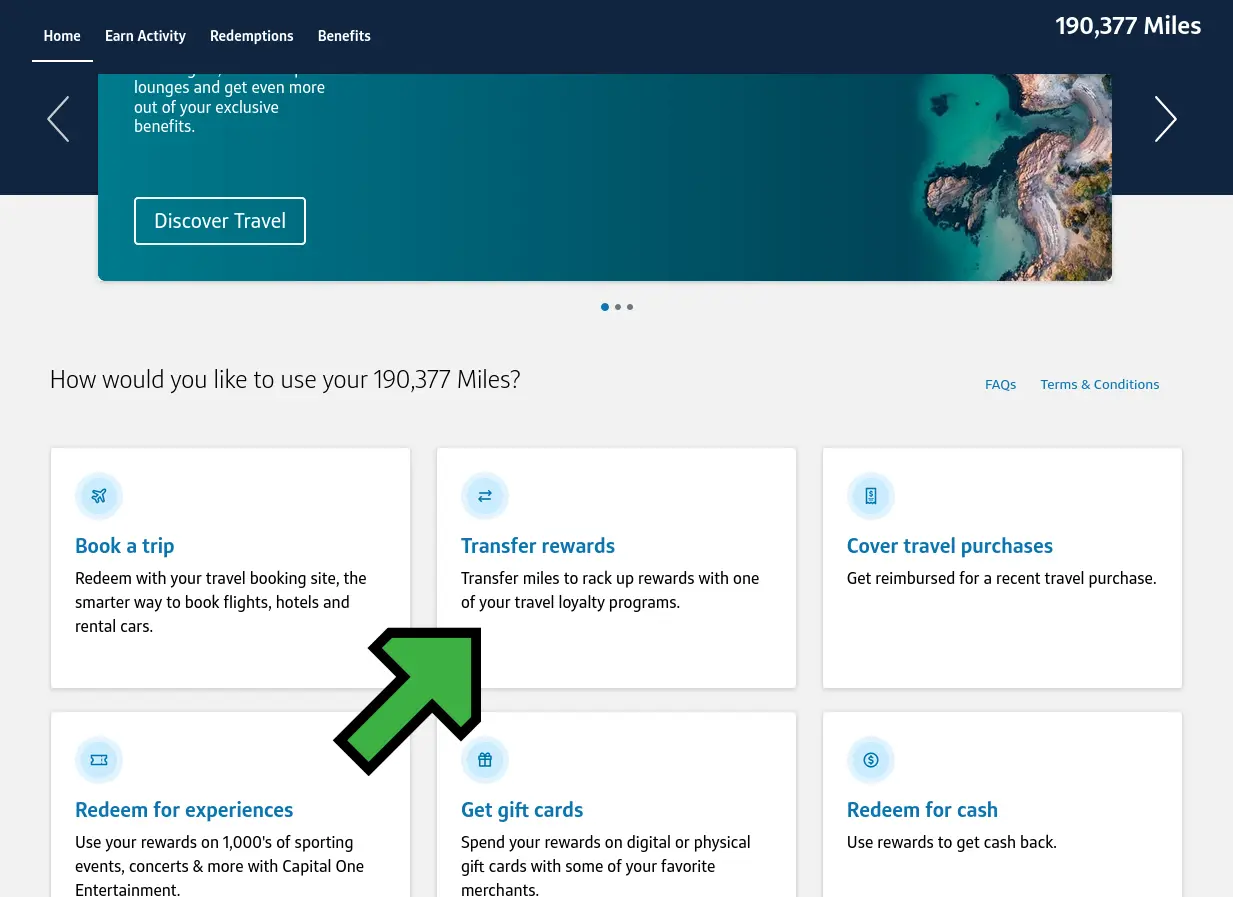

- Navigate to the "View Rewards" section: This is found on the main accounts page.

- Select "Transfer rewards": It might further down the page than shown.

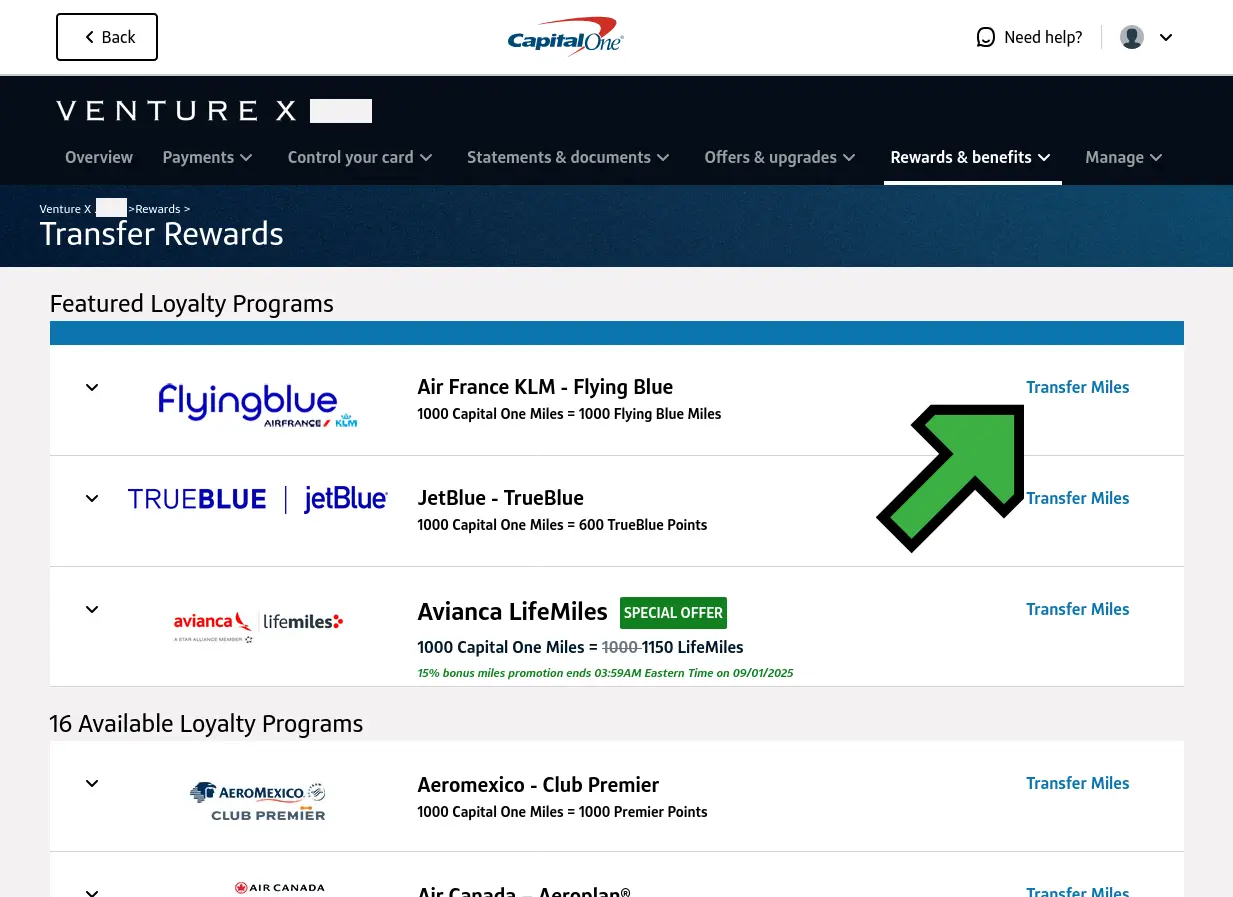

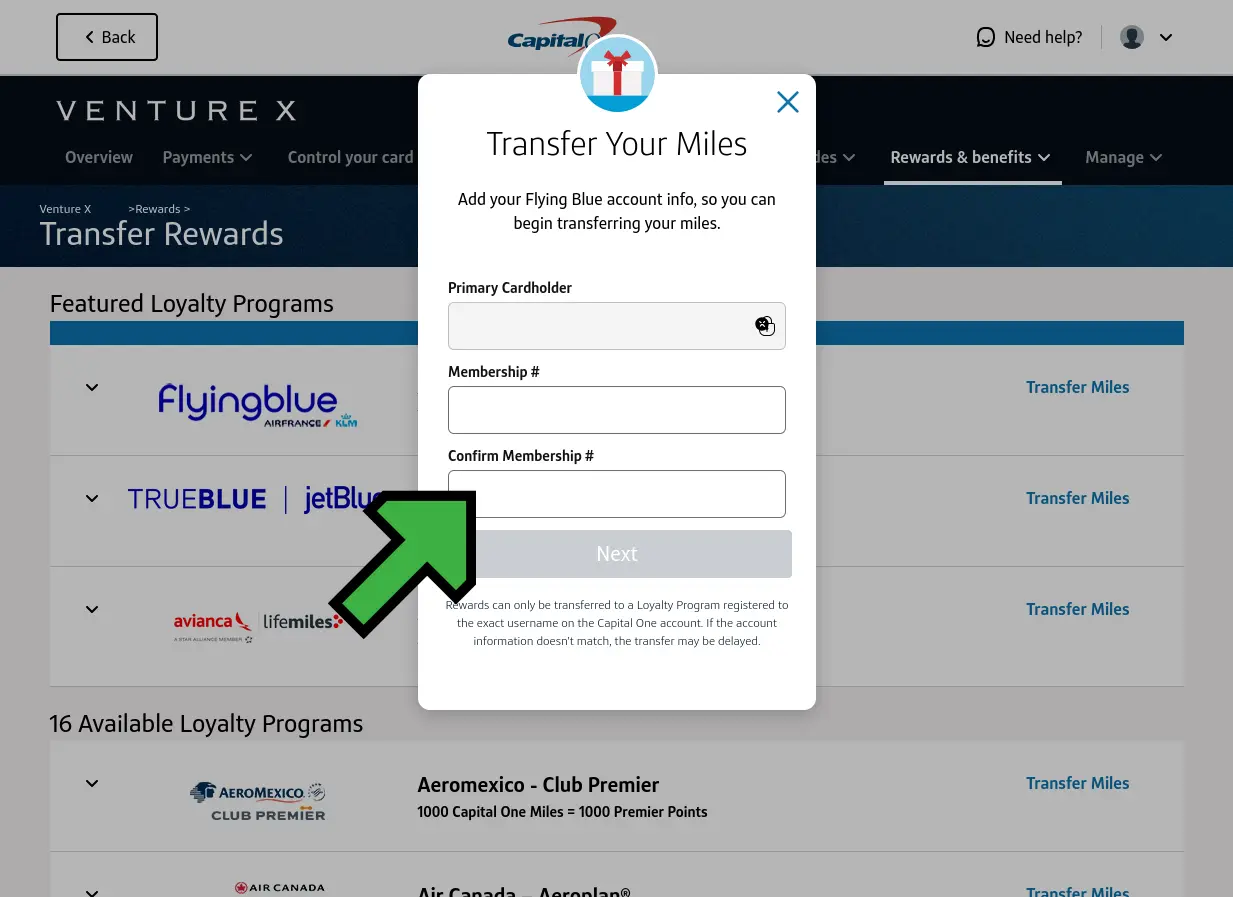

- Select "your desired airline partner": Choose from the list of available transfer partners.

- Enter your airline loyalty program details: You'll need your frequent flyer number for the chosen airline. Ensure the name on your Capital One account matches the name on your airline loyalty account to avoid issues.

- Specify the number of miles to transfer: Transfers are typically done in increments of 1,000 miles.

- Confirm the transfer: Review all details, including the transfer ratio and estimated transfer time, before finalizing the transaction.

Important Considerations:

- Matching Names: The name on your Capital One account must match the name on your airline loyalty program account.

- Irreversible Transfers: Once miles are transferred to an airline partner, the transfer is generally irreversible. Make sure you have a specific redemption in mind before initiating a transfer.

- Transfer Bonuses: Keep an eye out for limited-time transfer bonuses, which can offer an increased transfer ratio (e.g., 1:1.25), providing even greater value for your miles.

Best Ways to Use Capital One Miles

Capital One Miles offer excellent value when transferred to their airline partners, especially for international travel. The "best" way to use them often involves leveraging sweet spots within partner loyalty programs. Here are a few examples:

- Air Canada Aeroplan: A versatile program for Star Alliance redemptions, offering good value for flights to Europe, Asia, and within North America.

- Virgin Atlantic Flying Club: Offers fantastic value for booking Delta One business class flights to Europe or ANA First/Business Class to Japan.

- Avianca LifeMiles: Often has competitive redemption rates for Star Alliance flights and frequently offers sales on purchased miles, which can be combined with transfers.

- Emirates Skywards: Great for booking premium cabins on Emirates, especially their iconic A380 First Class.

- Turkish Airlines Miles&Smiles: Can be a sweet spot for domestic flights on United Airlines within the US, often requiring fewer miles than booking directly with United.

Always compare redemption rates across different partners and consider the cash price of the flight to determine if transferring miles offers good value.

Capital One Miles Transfer Bonuses

Capital One occasionally offers limited-time transfer bonuses to select airline partners. These bonuses can significantly increase the value of your Capital One Miles, making certain redemptions even more attractive. For example, a 20% transfer bonus to a specific airline would mean that 1,000 Capital One Miles become 1,200 airline miles.

It's always a good idea to check for current transfer bonuses before making any transfers. These promotions are typically announced on the Capital One Rewards portal and various travel blogs. Timing your transfers with these bonuses can lead to substantial savings on award flights.

Is it Worth Transferring Capital One Miles?

Transferring Capital One Miles to airline partners is often the most lucrative way to redeem them, especially for international business or first-class travel. While other redemption options like erasing travel purchases or booking through the Capital One travel portal offer a fixed value (typically 1 cent per mile), strategic airline transfers can yield a value of 1.5 cents per mile or even higher.

The decision to transfer miles should be based on:

- Your Travel Goals: Do you have a specific award flight in mind?

- Availability: Are award seats available on your desired dates and routes?

- Cash Price vs. Mile Value: Does the value you're getting from your miles outweigh the cash cost of the flight?

- Transfer Bonuses: Are there any active transfer bonuses that enhance the value of your miles?

For those willing to put in a bit of research and planning, transferring Capital One Miles can unlock incredible travel experiences that would otherwise be very expensive.

Capital One Miles Transfer FAQ

Do Capital One Miles expire?

Capital One Miles generally do not expire as long as your account remains open and in good standing. If you close a card that earns Capital One Miles, you typically have a grace period to use or transfer your miles before they are forfeited. Always check the specific terms and conditions of your Capital One account.

Can I transfer Capital One Miles to someone else's airline account?

Capital One generally allows you to transfer miles to your own loyalty accounts or to the loyalty account of an authorized user on your Capital One credit card account. Direct transfers to unrelated third parties are usually not permitted.

Are there fees for transferring Capital One Miles?

Capital One does not charge a fee for transferring miles to their airline partners. However, some airline programs may impose their own fees or taxes on award bookings, which are separate from the mile transfer itself.

Which Capital One card is best for earning miles?

The "best" card depends on your spending habits. The Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card are excellent for earning a flat 2X miles on all purchases. The Capital One VentureOne Rewards Credit Card is a good no-annual-fee option.

How much are Capital One Miles worth?

The value of Capital One Miles varies significantly depending on how you redeem them. For erasing travel purchases or booking through the Capital One travel portal, they are typically worth 1 cent per mile. However, when transferred strategically to airline partners for premium cabin award flights, they can be worth 1.5 cents per mile or more, offering the highest potential value.

Conclusion

Capital One Miles provide a valuable and flexible currency for travelers, particularly through their robust network of airline transfer partners. By understanding the earning potential of Capital One cards, the nuances of transfer ratios and times, and the strategic sweet spots within partner programs, you can unlock significant value for your award travel. Always stay informed about transfer bonuses and plan your redemptions carefully to maximize the utility of your Capital One Miles. Happy travels!

Disclaimer: Always use credit responsibly. This guide is for informational purposes only and does not constitute financial advice.